What is it about October? As flooding in parts of the UK subsides and the clear up following Storm Callum continues, investors are also taking stock of the damage wrought in the financial market storm of the last two weeks. The press were quick to compare Callum to the ‘Great Storm’ of 1987. Thankfully, so far, the falls in markets have not been on the scale of those witnessed 31 years ago, on Black Monday.

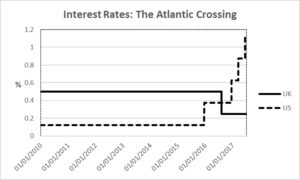

The trouble this time is a rapidly growing US economy rather than a slowing one. The Federal Reserve raised interest rates in September to 2-2.25% range and the minutes released yesterday suggest that more are to come. We have been here before, most recently in January and February this year, where fears of rapidly rising interest rates caused markets to fall. The Fed has been communicating to the markets that it expects to raise rates again this year (most likely in December) and another three rate rises in 2019. The sell off this month, as happened earlier this year, is that there will be more rises or by greater amounts, than has been suggested.

This is a case of good news being bad for the markets. The US economy is growing at its fastest rate for decades – over 4%pa – unemployment is low and Donald Trump’s tax cuts and promise to slash regulation has boosted sentiment further. Wages are increasing which has led to inflation rising above the target level of the Fed and as a response, interest rates have been increased. Any data which suggests wages or the economy is growing faster than expected, good news more broadly, will be interpreted by investors as a sign that interest rates will rise more sharply and therefore be bad news for markets.

A growing economy and rising interest rates are part of a normal economic cycle and have been repeated time and again since the establishment of the market economy. What is making the process more painful this time is the base from which monetary policy is moving. Interest rates have been at historic lows for nearly 10yrs following the financial crisis; governments have taken on massive debts in order to stimulate their economies and Central Banks have engaged in quantitative easing, swelling their balance sheets to unprecedented levels. All of this needs to be unwound and the US, being the first into and out of the crisis in 2008-09, is leading the way.

It is also still the dominant World economy and despite growth in Emerging Market economies, a lot of their debt is priced in Dollars and by extension linked to US interest rates. Therefore a rising Fed rate does more than affect US businesses and consumers. It threatens to cause debt crisis in over-leveraged Emerging Markets and if the strong Dollar weakens US demand for imports, manufacturers in East Asia will be affected also.

So what happens next?

Given the underlying economy in the US is so strong, and the Fed and the Government are more sensitive to a potential downturn, it is unlikely that interest rate rises will tip the US economy into recession. Economic growth across the World is more divergent than it was in 2017, however most economies are growing and therefore the underlying drivers of market returns are robust, so a full-blown market crash looks unlikely. What is more likely is that markets will continue to be flat, as they have shown to be this year, as rising interest rates dampen expectations of that rate of future profit growth and that profit is valued less in todays terms and therefore prices will come under pressure. At the same time there will be plenty of volatility as fears around the rate of increases ebbs and flows, not to mention the countless political and geo-political tensions brewing. Expect Italy, Brexit, Turkey, US-China trade wars and the Middle East to continue to dominate the headlines this year and next.

What can investors do?

Given that market levels, even now after the recent sell-off, are at long term highs, and that alongside this, levels of volatility and uncertainty are also high, taking some risk off the table is probably sensible. The trouble in doing this is what ‘safe assets’ to move into? Gilts and Government Bonds are at risk of capital falls as interest rates rise, particularly given the low rates they are moving from. Quantitative easing and a decade of low interest rates means that anything with a yield has been in high demand and so bonds across the investment risk spectrum are also at historic highs. They are also more susceptible than in the past to interest rate rises because of this. Therefore managers have been focusing on shorter duration, where there is less interest rate risk and whilst they may not perform well in the short term (where shares and bonds are affected by rate rises), should there be a greater market sell off, interest rates will be cut and bonds will be back in favour as the traditional safe haven.

Other than bonds there are alternative strategies such as property and cash. Cash is a good short term tactical play, given it has little cost and has the greatest liquidity. The downside is that if held for too long it is eroded by inflation. Alternative strategies are expensive but with a good manager have shown themselves to have low correlation to financial markets. Finally property, whilst still exposed to economic cycles and the least liquid of these assets, has maintained good yields and capital values have been fairly stable.

The recent market falls seem to have abated and markets found a new level. Unless corporate earnings are much higher than expected, I do not see markets racing ahead from here and so it may be some time before the previous highs are reached.

A full-blown market crash looks unlikely but repeats of the recent falls are likely, though hopefully accompanied by subsequent recoveries. A sensible strategy to navigate this would be a more cautious one, however one which also has a good yield. Whilst market levels fluctuate, investors can still generate positive returns by way of income. Re-investing this income will benefit from pound cost averaging in these turbulent times also.

We are living through one of the longest recoveries in history, which means a future downturn is closer than the one we left we left behind. Having interest rates at a higher level and monetary policy more ‘normal’ will mean more can be done to manage the next downturn. For economies such as the Eurozone (0% interest rates) and Japan (-0.1% interest rates) it will be much more difficult to manage.

In Summary

As always, the trick is to remain patient, ride it out, and look through the noise and sensationalist headlines. Bear in mind that whilst these gyrations are painful, they are necessary. The quote at the beginning of this article is by Benjamin Graham. He was a British-born American investor, economist and professor and taught Warren Buffet, among others. Graham said, of a particularly turbulent time in investment markets “In the old legend, the wise men finally boiled down the history of mortal affairs into a single phrase: “This too will pass.”

At Greenstone, we advocate three key principles to help you achieve your financial goals.

1) Have faith in the future and keep perspective.

Market downturns can be upsetting but history shows that major stock markets such as the UK and US markets recover from declines and can still provide investors with long-term returns. For example, during the past 35 years, the US market experienced an average drop of 14% from high to low during each calendar year, but still had a positive annual return in more than 80% of the calendar years in this period*

2) Patience

Work out a plan with your adviser. Articulate your key goals and understand how they might be achieved. Be patient about achieving them and make sure you are comfortable with your whole financial situation. Your adviser will have helped you to put together a portfolio that takes account of your time horizon, goals, tolerance for risk and capacity for loss. Speak to him or her about that plan if you need to refocus.

3) Discipline

Avoid doing the wrong thing. Market timing is a tricky game to play. There have been numerous studies over the years into the effects of moving in and out of the market. In fact, it is virtually impossible to consistently predict when good and bad days will happen. If you miss even a few of the best days, it can have a lingering effect on your portfolio.

That said, market downturns may be an excellent time to carry out some tax planning. For example, if you haven’t used your ISA allowance as yet this year, now might be a good time to do so. Alternatively, if you wish to sell some holdings that have performed well, a down-turn may provide an opportunity for some Capital Gains or Losses planning. This could help your overall financial position.

As ever, if you have any questions about this article or your investments, do please contact us your adviser on 020 3931 0340 or, for more general queries, contact us at info@greenstonefp.co.uk

*Fidelity; “6 tips to manage volatile markets”; Fidelity Viewpoints 01/08/2018