As you know, our Greenstone Portfolios reflect a systematic and evidence based approach to investment. We have spoken of the difficulties that go with choosing an active – or ‘judgmental’ – fund manager who will deliver market-beating returns. We believe that investors entrusting their capital to active managers risk an unnecessary transfer of their wealth in the form of high costs. They may also suffer the fate of returns lower than that of the benchmark over the longer term, evidenced by the track record of many active managers.

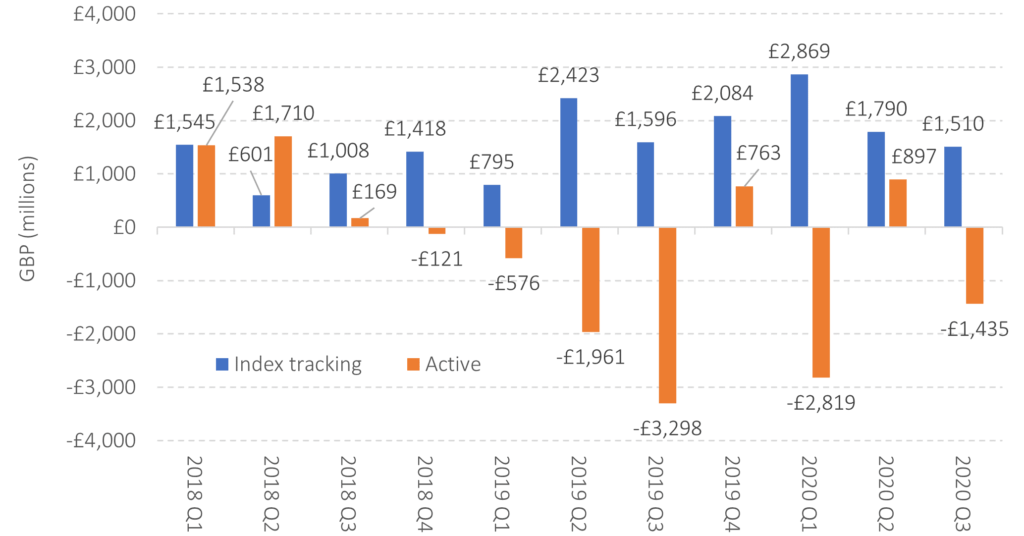

Recent history has seen investors transferring their wealth from active into typically lower cost index tracking funds. This is good news for investors and the investment industry as a whole. Due to the lower cost solutions being used, investors should benefit from a lower ‘cost drag’ and receive returns closer to the market. This move also gives an opportunity and incentive for the active management industry to focus on delivering better value at a lower cost to the end investor. Only time will tell the extent to which this becomes a reality.

UK investor net flows into active and index-tracking strategies Q1 2018 to Q1 2020

Data source: Calastone © Copyright. All rights reserved. Calastone Fund Flow Index October 2020. www.calastone.com

Some critics argue that these flows pose risks to ‘price discovery’ (i.e. stocks being properly priced). It is true that if investors continued to move from active to passive indefinitely that market prices would become dislocated from their true value, as everyone becomes a price taker and not a price maker. The reality is that price discovery is a function of the trading volume of active investors (i.e. how much is bought and sold each day) rather than the value of what is being traded. We are a long way from this phenomenon becoming an issue as a Vanguard study showed indexing only makes up around 5% of daily trading volume.

Also, in a situation where market prices are incorrect, opportunities will arise for active managers to harness these inefficiencies and outperform markets, after which money would flood back to actively managed funds to the point that the prices are once again fair. We live in an arbitrage-free world (there is no such thing as a free lunch!).

Our Investment Committee tirelessly reviews all new evidence that challenges or supports this approach. The current evidence continues to support our approach as it suggests that focusing on a low cost and diversified approach gives investors a strong chance of experiencing a successful outcome.

This does not constitute advice. Professional advice should be taken prior to acting on any part of it.